Budgeting and Quote tools Automation solutions for your company

Keeping a record of your daily spending can be daunting, especially if you use traditional methods such as pen and paper or an Excel sheet. In addition, keeping track of expenses may seem tedious, but managing your finances is crucial.

Even though manual budget tracking is a common practice for many businesses, it is not the most reliable or accurate. Despite its widespread use, Microsoft Excel and Google Sheets have been found to contain errors in up to 89% of all spreadsheets. This poses a significant risk to the accuracy and reliability of budget tracking, as manual data entry and calculation can lead to small mistakes that accumulate and become more important issues.

Thankfully, plenty of budgeting software options are available, with customized plans to suit any business size. For example, for small businesses, there is a range of budgeting software packages with limited features that will keep the bank intact.

Essentially, investing in budgeting tools can offer peace of mind that a business's financial operations are being managed best. Your focus can be on your clients instead of paperwork with the software.

No less important is quoting software. The software works by automatically collecting the necessary information about the customer and their requirements, then using this data to generate an accurate and up-to-date quote. This streamlines the process and removes potential errors when manually entering data.

Our article will show you how to choose the proper business budgeting and quoting tools for your company's finance department. Let's begin!

What is Business Budgeting Software?

Business budgeting software is a technology solution designed to automate and optimize the budgeting process. Using Budgeting tools can help you save time and improve accuracy in the budgeting process.

In contrast to Spreadsheets, Excel, and Legacy FP&A software, custom-designed business budgeting software enables businesses to plan and manage forward-looking business performance projections.

With business budgeting software, businesses can make more accurate forecasts, helping them plan for the future more confidently. The software is easy to deploy, flexible, and provides a collaborative environment that allows teams to work together seamlessly.

Business Budgeting Software & Key Features:

Business budgeting software should have several key features to be effective. These features may include:

-

Automated forecasting feature lets users quickly and accurately forecast future business expenses.

-

Flexible budgeting feature allows users to quickly and easily adjust budgeting plans as needed. It also allows users to create multiple budgets for different departments or projects.

-

Reporting feature allows users to generate detailed reports on their budgeting efforts. In this way, the budget will remain accurate and current.

-

Security feature ensures that the budgeting information is kept securely and is only accessible by authorized personnel.

Examples of best Business Budgeting Tools

1. QuickBooks

The most popular budgeting software for small businesses is QuickBooks. It offers an intuitive user interface and helps you track your finances, manage accounts payable and receivable, and generate reports.

QuickBooks allows users to pay bills, run payrolls, and reconcile bank accounts from their desktop or mobile device.

2. FreshBooks

This cloud-based accounting software and app is designed specifically for solopreneurs and small business owners and is ideal for companies with 1-50 employees. Managing finances and understanding it is easy with the user-friendly interface.

This software enables its users to track time, create invoices, and manage expenses on one platform. It's great for entrepreneurs and small businesses, as it helps them stay organized and efficient.

3. Planning Maestro

Planning Maestro is an advanced financial planning, budgeting, forecasting, and analytics tool, designed to empower finance teams to collaborate on model budgets. With Planning Maestro, users can access integrated data from multiple sources on Windows and Linux desktops or on-premise, giving them the power to work with financial data wherever they are.

Planning Maestro is an excellent tool for finance teams looking to stay on top of their financial plans, but they need a mobile platform complementing its desktop version.

Picture 1. Examples of best budgeting tools.

Other Budget Automation Software Examples:

-

Float

In terms of cash flow management budgeting software, Float is an excellent example. With its awesome visual reports and easy setup, you can gain insight into your daily, weekly, or monthly cash flow data.

-

Gide

Gide is the perfect business budgeting tool for financial professionals and investment managers. It includes everything you need, from budgeting to forecasting to creating reports, and has a comprehensive and error-free calculation engine. Gide stands out because of its real-time collaboration feature, enabling users to collaborate seamlessly.

3. PlanGuru

PlanGuru is an excellent choice for small businesses and their financial needs. It is a budgeting and forecasting software compatible with Excel and QuickBooks, making it incredibly user-friendly. With PlanGuru, you can create accurate cash flow forecasts from balance sheets and income statements and use debt modeling tools to evaluate and improve your business performance.

Best budgeting tools for scaling up with workflow automation

1. Spendesk

With Spendesk, finance teams have greater visibility and control over their company's finances. This all-in-one solution offers a robust budgeting system that integrates seamlessly with a cloud-based platform. This integration significantly simplifies managing invoices and employee expense reimbursements, two of the most challenging tasks for companies trying to maintain financial control. With this comprehensive spending solution and budgeting tool, you can better manage and monitor company spending, making it easier to control your finances.

2. Scoro

Scoro is a powerful work management software combining accounting automation and workflow optimization. As one of the leading budgeting tools, this software offers real-time financial reporting, allowing finance teams to monitor and track their company's spending patterns and identify potential vulnerabilities and opportunities.

Among this software's top features are: Quoting automation, PDF export, CRM, Sales pipeline reporting, Billing automation, Reporting features, Project and work management features, Customization features, and a wide range of available integrations.

3. Adaptive Planning

Adaptive Planning is built for mid-size and enterprise-level budgeting, Planning, and forecasting. With this cloud-based software, all company expenditures can be viewed comprehensively. Among budgeting tools, this one simplifies budgeting and allows finance teams to keep track of expenses more effectively.

Pricing for Adaptive Planning varies based on the company's individual needs. Adaptive Planning pays off in the long run since it allows companies to react to market changes more quickly. Furthermore, it provides accurate tracking of budgeting costs.

Picture 2. Best budgeting tools for scaling up and workflow automation.

Quote Tool Development and Automation

Quoting software is quickly becoming an essential part of sales operations, streamlining and automating the proposal and request for proposal process. With integrations such as CRM, e-signature, accounting, and e-commerce software, the entire sales process is becoming much more efficient.

In addition to PDF, Word, and HTML formats, quote tools allow businesses to generate quotes and proposals. Such pages are especially effective, as they get approved approximately 18% more often than other formats.

Here are sixteen quoting tools to help you manage your business more effectively:

1. Qwilr

Qwilr is a revolutionary tool for streamlining the sales process and helping businesses close more deals. Instead of using traditional Word/PDF/PowerPoint documents, Qwilr creates interactive webpages that are beautiful and easy to use.

Qwilr is the perfect solution for those looking to ditch their PDF proposals, quotes, and presentations for something more interactive and mobile-friendly. Using Qwilr, you can easily create beautiful, interactive web pages. Plus, they look great on any device.

2. DocSend

DocSend features include Advanced document tracking, Manager insights, Teamwork and collaboration, Document control, Remote presentations, Custom branding, Training, and support.

3. Bitrix24

Whatever size or type of business you run, Bitrix24 offers a range of features that can be tailored to meet your needs. In addition to its impressive quoting capabilities, Bitrix24 includes comprehensive CRM and project management tools.

Bitrix24's quotes and invoices are fully customizable and come with a range of valuable features. These features include multi-currency support, taxes, automatic numbering, product catalogs, and email marketing. As a result, businesses can easily create customized quotes and invoices that meet their specific requirements.

The importance of Automation and Custom Software Development for companies

Maintaining up-to-date technology can help you manage your finances better, and reduce budgeting and quoting times. Further, you can use it to optimize your budget and data. Automating sales-related activities can improve efficiency and productivity, and according to McKinsey & Company (2020), more than 30% of such activities can be automated.

Custom-designed quoting and budget management software can help you stay competitive in the marketplace and streamline financial management. Using this technology, you can automate sales-related activities and increase profitability while saving time.

Calculating a budget is usually not an easy task and can pose the following problems:

-

The algorithm for calculating prices may be quite complex and time-consuming.

-

Excel quotations are delayed by days or weeks.

-

With the highest price but one that is acceptable to a client, sales want to hit the target

-

The budget needs to be filled in and adjusted based on client requests once it is ready

-

Calculation and proposal preparation steps involve human factors, so sometimes mistakes occur

-

Presentations for other clients usually keep sales busy

Key benefits of Business Automation:

-

By automating sales processes, businesses can provide customers with easier, more efficient ways to make purchases.

-

Automation can help businesses become more competitive, agile, and successful.

-

Automation can help businesses stay ahead of competitors, reduce operational costs and increase efficiency.

-

Automation can help businesses increase their sales and customer satisfaction.

-

Automation can be used to improve the accuracy of business operations and help businesses become successful.

How does BitsOrchestra approach automation?

Speed and accuracy are key factors in this process. Nevertheless, the fun doesn't end there, as you can enjoy the additional benefits of business automation.

The list below is how BitsOrchestra sees the benefits of business automation:

-

The more deals you get, the more revenue you generate

-

Your market share grows as your operations become more efficient and you gain more clients

-

Your business gets ahead of the competition

A business' success also depends on its sales representatives. They are the ones driving revenue and the ones that keep the business moving forward. When they are successful, they are motivated to keep working and reaching those goals.

Encouraging their success is essential to having a successful business, as it helps them to stay motivated and drive more revenue. Protecting your business's intellectual property is also important.

This means that instead of coding your process into spreadsheets, which can be easily copied and taken by someone leaving the company or sold to a competitor, you should keep it hidden under the hood of a web interface.

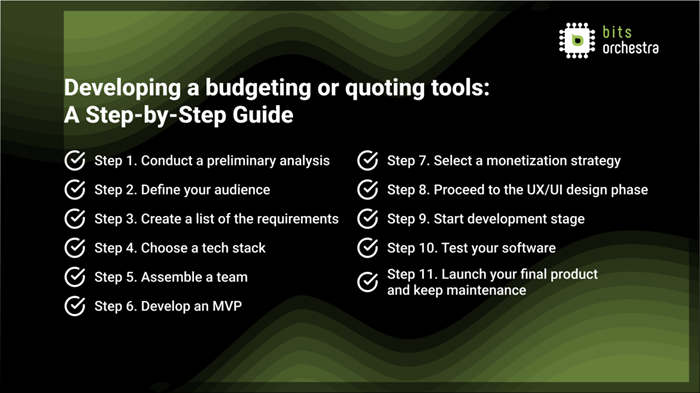

Developing a budgeting or quoting tools: A Step-by-Step Guide

After familiarizing yourself with the best examples of finance apps, it's time to move forward with building your own.

-

Step 1. Conduct a preliminary analysis

Make a list of requirements for:

-

functionality

-

design

-

size

-

number of features

The next step is to rank the features by importance after defining the set of features. This approach lets you determine which qualities are most valuable for the app.

-

Step 2. Define your audience

To understand your target audience's pain points and the problems they seek to solve, you must define your target audience after you've passed the first step. A successful marketing plan requires knowing your user and determining the feature set accordingly.

-

Step 3. Create a list of the requirements

List your requirements for functionality, design, size, and features. The next step is to rank the features by importance. Using this strategy, you'll be able to figure out what your app needs.

-

Step 4. Choose a tech stack

Once you've decided on the features for your budgeting or quoting software, the next step is determining which tools and technologies you'll need to make it a reality. Choosing the right approach for your app will depend on your budget and time constraints.

-

Step 5. Assemble a team

When developing the best software solution, remember that it will require technical skills and a deep market understanding. It would help if you had experts like a project manager, a UI/UX designer, a mobile developer, a backend engineer, and a QA engineer.

-

Step 6. Develop an MVP

Validating customer learning through the development of a minimum viable product (MVP) is a great idea. An MVP allows teams to focus on developing a product that can be quickly tested on the market with the least resources.

-

Step 7. Select a monetization strategy

What's your income plan? You should monetize your app based on your users' specific needs.

-

Step 8. Proceed to the UX/UI design phase

A good UI/UX design for financial services must be well-organized, clean, and easy to use. Moreover, your personal finance app should take at most three steps to access it.

-

Step 9. Start development stage

Developing a finance app requires qualified specialists and expertise. The developers implement the features of the financial application step by step once the scope of work has been approved.

-

Step 10. Test your software

Ensure your finance app is functional and non-functional with manual and automated tests. In manual testing, you can catch bugs in the earliest stages of software development, while in automated testing, you get immediate feedback and increase test coverage.

-

Step 11. Launch your final product and keep maintenance

After everything's been verified, it is time to launch your financial application.

Picture 3. Developing a budgeting or quoting tools: a step-by-step guide.

Quote tools: why should companies invest in it?

-

The need to win deals in sales

-

The need to have effective system of quotes distribution

Additionally, companies must have an effective system that allows for the rapid and accurate creation of proposals and quotes. The key to this is in the speed and accuracy of operational processes and procedures.

-

The need to ensure that teams are equipped with necessary tools

Furthermore, companies must ensure that their sales teams are equipped with the necessary tools to build accurate and compelling proposals. Having the right technology is also essential. Access to resources such as templates and automated quoting systems can make a big difference in the speed and accuracy of proposal creation.

-

Adapting to changing market conditions is also necessary

Furthermore, automation allows businesses to respond to customer needs more quickly and adapt quickly to changing market conditions.

-

The need to reduce operational costs

Lastly, automation can also reduce businesses' costs by reducing labor costs, increasing efficiency, and reducing operational costs.

For all these reasons, companies need to invest in solutions that help them track customer data, create quotes, and generate proposals efficiently. With the right automation tools, sales teams can speed up operations, track customer information such as buying preferences, and respond to customer requests more quickly. By streamlining these processes, companies can always be one step ahead of the competition.

Why choose BitsOrchestra for your software development needs?

If you're looking for quoting and budget management software that's custom-made, you've come to the right place.

At BitsOrchestra, we understand that businesses need to be able to quickly and accurately calculate quotes for their customers. Therefore, we can develop any quote calculator to meet different industries' needs and complexity levels.

Whether it is a workspace planning calculator for the furniture industry, an area rug calculator for flooring, multiple mortgage and loan calculators for financial organizations, a sales tool for HVAC, or a drugs calculator for veterinary pharma - we can do it all. All we need from you is more information.

Feel free to contact us. We would happily inform you about our quote tools and custom-made budget calculators.

Author

Roman Hutnyk

_1.jpg?width=270&height=270&ext=.jpg&maxsidesize=338&resizemode=force)